ROI GENOME FLASH

How Australian brands are missing out on an improved 30% ROI for their advertising spend.

With tough economic headwinds blowing, marketers will be looking at their budgets to locate inefficiencies. And as Analytic Partners' ROI Genome reveals, the first place to start might be streaming TV - with millions of dollars worth of lost sales opportunities being left on the table.

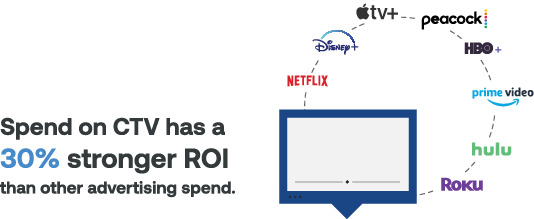

Streaming TV is also known as Connected TV (CTV), and is video content consumed on a TV screen through an internet connection. CTV encompasses services such as subscription video on demand (SVOD), like Disney+, Prime and Netflix, but also local offerings like broadcast video on demand (BVOD).

Investment into marketing channels such as Facebook, Google and Amazon has increased over recent years, which has chipped away at the budget traditionally allocated to linear TV. And while streaming TV services such as Disney+, Hulu and Netflix have adopted increasingly dominant positions on the market, they haven't experienced corresponding growth in streaming video ad spend. This inequality also extends to BVOD services like YouTube, Stan and Foxtel, which have taken an increasingly dominant position in the consumer television market. These brands now sit alongside other interface opportunities such as Roku, but without proportionate increase in streaming video advertising spend.

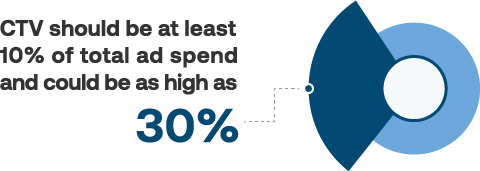

Our research shows that spend on CTV has a 30% stronger return on investment than other advertising spend. And with ad-supported streaming services evolving to replace or supplement their subscription models, now is the time to grab this opportunity.

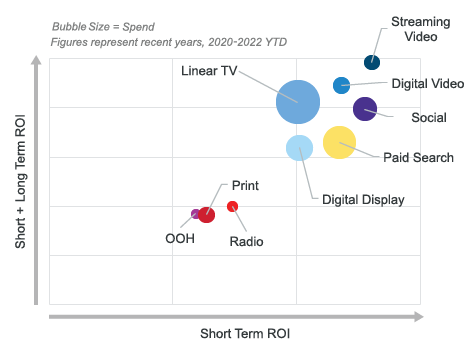

Take up of CTV as a marketing channel has been slower than other digital channels for a number of reasons, but the perceived difficulty in measuring impact is a key one. Many digital channels offer the perception of immediate impact, based on click-throughs or other tools. This makes them appealing because the spend can be justified and adjusted in real time.

However, with effective and comprehensive measurement programs, such as Analytic Partners’ Commercial Mix Analytics, this concern can be easily addressed. We can demonstrate that CTV spend offers outsized ROI and does so over both the short- and long-term.

Video’s lasting impact is twice as long as non-video media tools. In fact, video advertising continues to impact buying decisions not just in the short term - this week and next week – but also in the medium to long term – i.e. next month and beyond.

This effect is why CTV benefits are so often underrated. The use of simplistic attribution and “last-click” (the last touchpoint before a consumer makes a purchase) for measurement purposes does not take longer-term buying processes into account.

One key watchout is that this doesn’t mean just doing really cheap and short duration video. We’ve measured the ROI of online video in Australia, and you can see below that while 6s video typically has a higher performance than 15s or 30s, the highest performer is over 60s- and over 90s have the highest impact there. Clearly that’s with an intelligent targeting strategy, and it’s not just a long ad- it’s a different form of story telling, but it does show that while the day of the 60s TVC may be gone, it doesn’t mean you can’t run that content in any channel.

Another factor to consider when looking at CTV and video, in general, is that it impacts performance and lower funnel marketing channels. For example, ROI Genome shows that 30% of paid search clicks are driven by other forms of advertising – most of which are from video media budgets. This ultimately means that without video, a large amount of searching wouldn’t take place at the same level, and there would be a corresponding drop in purchases.

Seizing the opportunity

It’s all very well to say that brands should be using CTV and increasing their spend, but what will this look like?

Currently, brands are dipping their toes in the CTV waters, but investment on streaming TV video is low, averaging just 7% of total spend even in established markets like the US. But on that 7% spend, they’re seeing ROI that is 30% higher than for other marketing channels and tactics. Analytic Partners recommends that CTV and streaming video spending should be at least 10% of total advertising spend, but preferably closer to 20% and, in some cases, could arguably go as high as 30%.

Of course, as with any marketing spend, there needs to be careful consideration and implementation. While there is improved ROI across the board, high consideration brands with longer purchase decisions will see an even higher impact from CTV spend than brands with lower considerations.

It’s also true that consumers do not respond to bombardment, so your CTV dollars should be wide reaching and not concentrated on a single target, genre or streaming service. Wherever possible, leverage frequency caps.

And as with any marketing spend, it needs to be considered as part of a holistic marketing mix. Replacing all linear TV spend with CTV spend, for example, is likely to be counter-productive. This will exclude audiences and geographic areas for which this remains the primary viewing source.

Savvy scenario planning that takes historical measurements and results into account will help to ensure the mix is optimised for each brand.

About Analytic Partners

Analytic Partners is the leading cloud-based, managed software platform which provides adaptive solutions for deeper business understanding and right-time planning and optimization for marketing and beyond. We turn data into expertise so that our clients can create powerful connections with their customers and achieve commercial success.

Analytic Partners ROI Genome

For over two decades, Analytic Partners has collected vast quantities of marketing intelligence across more than 750 brands, 45 countries, and hundreds of billions in spend across industries. ROI Genome presents that intelligence to help marketers understand the tactics, channels, and strategies that drive ROI and performance.